Exness Islamic Account

These accounts let Muslim traders buy and sell financial products while following Islamic rules.

What are Exness Islamic Accounts?

Regular trading accounts often charge a fee called “swap” when you hold positions overnight. This fee works like interest, which goes against Islamic principles.

Exness Islamic Accounts do not have any swap fees. This means you can trade without paying interest-like charges. Your trading activities will fully comply with Islamic laws and beliefs.

| Feature | Description |

| Swap-Free Trading | No overnight interest charges on open positions |

| Sharia-compliant | Upholding Islamic financial principles |

Set Up Your Exness Islamic Trading Account

Getting an Islamic account at Exness is straightforward, even for newcomers. Follow these easy steps:

Step 1: Access the Exness Website

Using a popular web browser, search for “Exness” to locate the company’s official website. This user-friendly platform will guide you through the account opening process.

Step 2: Start Account Creation

Look for the prominent “Open Account” button on the homepage and click it.

Step 3: Complete Registration Form

The registration form will require you to provide basic personal information, such as your full name, email address, and the currency you prefer for your trading account. Take care to select the currency you’re most comfortable trading in.

Step 4: Choose Account Type

During the account registration process, Exness will present you with various account options. To ensure interest-free trading in compliance with Islamic principles, be sure to select the “Islamic Account” option.

Step 5: Prove Your Identity

For security reasons, Exness requires all new clients to verify their identities. This typically involves uploading scanned copies of your government-issued identification document (such as a passport or national ID card) and a recent proof of address (like a utility bill or bank statement).

Step 6: Add Trading Funds

Once your identity has been successfully verified, you can proceed to fund your new Islamic trading account. Exness offers a range of convenient payment methods, including debit/credit cards, bank transfers, and e-wallet solutions like Skrill or Neteller.

Step 7: Begin Trading!

With funds added, you can now access Sharia-compliant financial instruments and start trading!

Understand Costs on Exness Islamic Trading Accounts

While Exness Islamic Accounts don’t have swap fees, there are still some costs for your trades. Let’s look at the two main factors affecting trading costs:

1. Commissions:

- Some Islamic Account types at Exness have commissions charged per trade. A fixed amount is paid when opening and closing a position.

- Other Islamic Accounts may offer commission-free trading. Check the details of your chosen account during sign-up.

2. Spreads:

- Spreads are the difference between buy and sell prices of a financial product. This gap must be covered to profit from a trade.

- Exness Islamic Accounts typically have variable spreads, which can change based on market conditions.

- Exness offers various Islamic Accounts with different minimum spreads. Research and pick an account matching your trading style and preferred spread range.

Quick Tip:

Compare commission structures and typical spread ranges across Exness Islamic Account types before opening one. This helps choose an account minimizing overall trading costs according to your needs.

Trade Halal Financial Products with Exness Islamic Accounts

With your Exness Islamic account, you can trade various financial products approved under Islamic principles.

The main Sharia-compliant instruments available:

Currency Pairs

- Major pairs like Euro/US Dollar, British Pound/US Dollar, US Dollar/Japanese Yen

- Cross-currency pairs such as Euro/British Pound, Australian Dollar/New Zealand Dollar

Precious Metals

- Gold and silver trading

- Physical commodities permitted in Islamic finance

Stock Indices

- Tracks major global stock indexes like S&P 500, FTSE 100, Germany 30

- Avoids direct company stock investment

All these instruments have been carefully vetted to comply with Islamic rules against interest (riba), excessive risk (gharar), and impermissible activities.

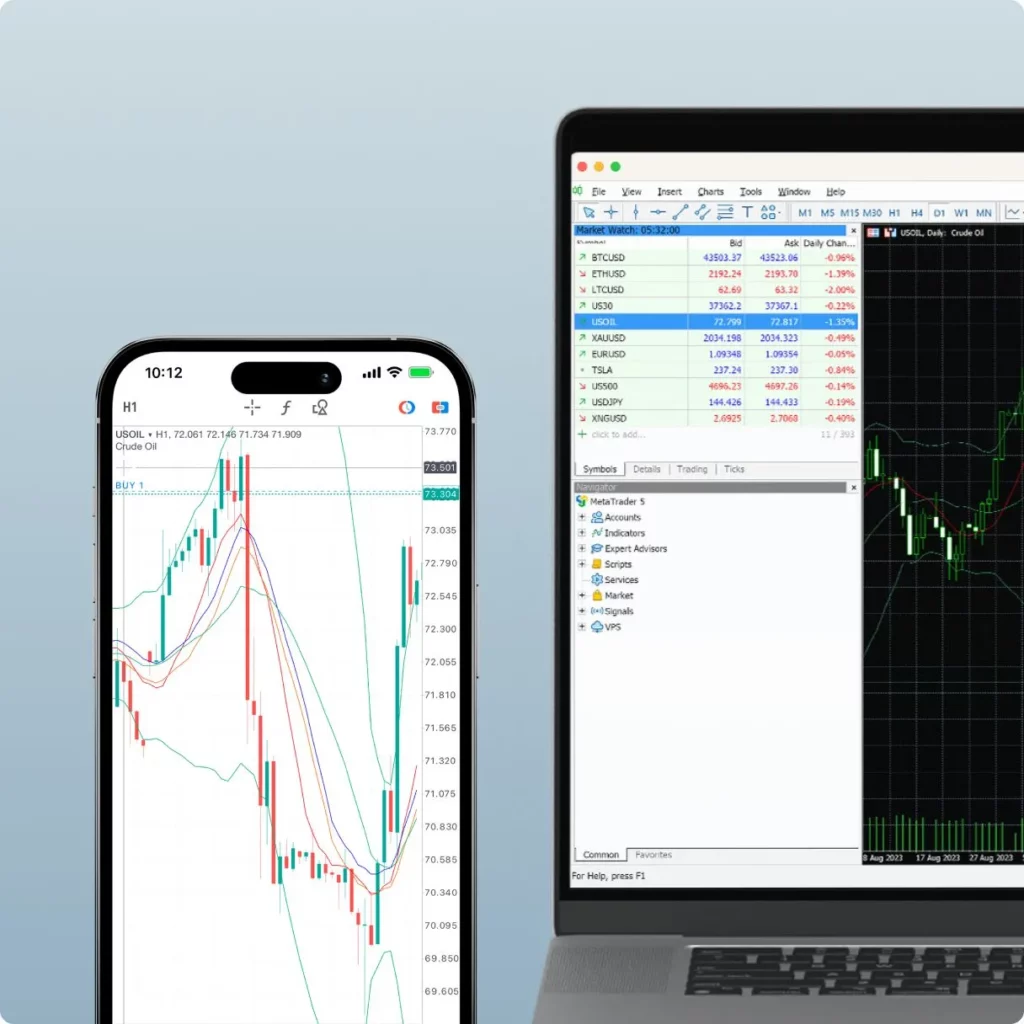

Trade these products through Exness platforms while enjoying swap-free Islamic account conditions. Your account adheres to Islamic finance principles, allowing confident Halal trading aligned with religious laws.

Countries Where You Can Open an Exness Islamic Account

Exness Islamic Accounts are accessible to traders from numerous countries worldwide. Here’s a list of some major regions and countries where you can open and trade with an Exness Islamic account:

Middle East:

- United Arab Emirates

- Saudi Arabia

- Kuwait

- Qatar

- Bahrain

- Oman

Asia:

- Malaysia

- Indonesia

- Pakistan

- Bangladesh

- India

- Kazakhstan

Africa:

- South Africa

- Nigeria

- Egypt

- Morocco

- Algeria

- Tunisia

This list covers many Muslim-majority nations as well as countries with sizable Muslim populations. However, it’s always wise to check Exness’ website for the most up-to-date information on available countries for opening Islamic accounts.

If your country isn’t listed, you can inquire with Exness about eligibility requirements. The company may expand its Islamic account offering to more regions in the future.

Commonly Asked Questions: Exness Islamic Account

Does Exness Offer Interest-Free Islamic Trading Accounts?

Yes, Exness provides Islamic Accounts designed to follow Sharia law. These accounts eliminate overnight swap fees (interest charges) on open positions, ensuring trading activities comply with the prohibition of riba (usury) in Islamic finance principles.

What is the Minimum Deposit for an Islamic Account?

The minimum deposit amount for Exness Islamic Accounts may vary based on the chosen payment method and your location. Check Exness’ website for the latest minimum deposit requirement applicable to your specific situation.

What Islamic Account Types are Available at Exness?

Exness may offer multiple Islamic Account variants, potentially with differing features like minimum spreads or commission structures. During account opening, select the “Islamic Account” option, then explore the details of each available type to find one best aligned with your trading preferences.

Are There Any Additional Fees for Exness Islamic Accounts?

While Islamic Accounts don’t have swap fees, other trading costs may still apply:

- Commissions: Certain account types could have per-trade commission charges.

- Spreads: The gap between an instrument’s buy and sell price. Choose an account type with spreads suitable for your trading approach.

Before opening an Islamic Account, review the specific fee schedule of your chosen account variant to understand all associated costs.

Can Muslim Traders Use the Exness Demo Account?

Yes, Muslim traders can absolutely use the Exness demo account. The demo account allows you to practice trading in a risk-free environment using virtual funds, before transitioning to a live Islamic account.