Minimum Deposit at Exness

Traders prefer Exness for its low entry barrier; you can start trading with just $1 or $10. The flexibility comes from their no minimum deposit requirement for standard accounts, which simply depends on your payment method.

When selecting a broker, consider more than just the minimum deposit; look into other key factors as well. It’s crucial to evaluate trading conditions like spreads, commissions, leverage, available instruments, and execution quality. We will guide you on selecting the best deposit method and account type to suit your trading preferences.

Deposit Rates by Exness

The Exness Broker shines with its flexible deposit rates, appealing to traders of all levels. The minimum deposit changes based on the account type you choose. For instance, Standard Accounts offer an incredibly low minimum deposit, making them a go-to for new traders. Professional Accounts, however, ask for a higher minimum deposit due to the advanced tools and features they provide for seasoned traders.

The minimum deposit isn’t just about starting to trade. It affects other key trading aspects like margin calls and leverage too. It’s crucial for traders to realize that lower deposit requirements might make it easier to start trading but can also increase risk, particularly in unpredictable markets. Exness stands out by offering 9 different accounts, more than most brokers, catering to beginners and experienced traders alike.

When it comes to trading fees, our tests of all Exness accounts showed that Standard accounts have slightly higher than average trading costs. However, Pro accounts offer trading costs significantly below average, making them highly attractive for serious traders.

| Standard | Standard Cent | Pro | Zero | Raw Spread | |

| Minimum deposit | Depends on payment system | Depends on payment system | $200 | $200 | $200 |

| Spread | From 0.2 pips | From 0.3 pips | From 0.1 pips | From 0 pips | From 0 pips |

| Commission | No commission | No commission | No commission | From $0.05 each side per lot | Up to $3.50 each side per lot |

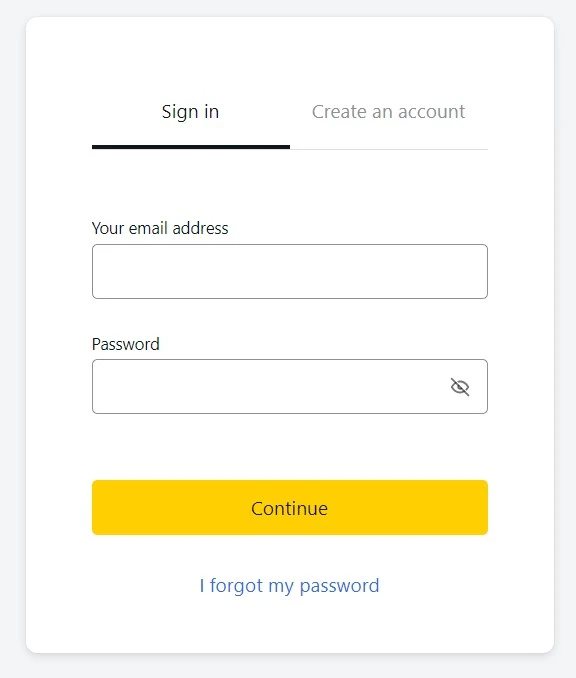

How to Deposit Minimum Funds on Exness

To add funds to your Exness account, simply follow these steps:

- Sign into your Exness account.

- Navigate to the “Deposit Funds” area.

- Select your desired deposit method from those listed.

- Specify the amount you want to deposit.

- Adhere to the given instructions for the payment method you’ve chosen.

- Finalize your deposit by confirming the transaction.

Your funds will be added to your Exness account after the transaction is successfully processed. Always stay informed about any modifications to deposit options and guidelines on the Exness platform.

Deposit Methods and Associated Fees at Exness Broker

Exness Broker offers a range of deposit options for traders, including bank wire transfers, credit/debit cards, and online payment platforms like Skrill and Neteller. Each method comes with its own set of fees and processing times. For instance, while bank transfers might be slower, they typically have lower fees compared to the instant processing of credit/debit cards, which come with higher fees. Online payment systems strike a balance with moderate fees and quick processing times. Consider these factors when choosing a deposit method.

Deposit Methods Available at Exness

Exness caters to its global clientele with a wide array of deposit methods, ensuring accessibility and convenience. The broker offers traditional and modern options, tailored to meet diverse preferences. However, availability may vary depending on location and regulatory requirements.

Deposit methods at Exness include:

- Bank Wire Transfers: Suited for those favoring conventional banking. Although widely available, processing times tend to be slower.

- Credit/Debit Cards: Accepted worldwide, including major types like Visa and MasterCard. Known for simplicity and widespread use.

- E-Wallets: Popular platforms such as Skrill for speedy transactions, Neteller for secure online payments, and WebMoney for comprehensive security features.

| Payment Methods | Deposit Amount | Deposit processing time | Withdrawal Amount |

| Neteller | 10 – 50,000 USD | Maximum: up to 30 minutes | 4 – 10,000 USD |

| Skrill | 10 – 100,000 USD | Maximum: up to 30 minutes | 4 – 12,000 USD |

| Perfect Money | 10 – 100,000 USD | Maximum: up to 30 minutes | 2 – 100,000 USD |

| Sticpay | 10 – 10,000 USD | Maximum: up to 30 minutes | 1 – 10,000 USD |

| Online Bank | 15 – 1000 USD | Maximum: up to to 1h | Varies depending on your specific banking provider. |

| Bank Card | 10 – 10,000 USD | Maximum: up to 30 minutes | Varies depending on your specific banking provider. |

Exness Deposit Charges and Fees

Exness ensures a straightforward approach to deposit charges and fees:

- There are no deposit charges across all account types.

- Depositing funds into your Exness account is free of charge.

- Exness absorbs any deposit fees charged by payment systems, such as those for bank wire transfers.

- While some payment methods might have their own fees, these will be clearly shown when you make a deposit.

- It’s a good practice to regularly check the Exness platform for any changes or updates regarding deposit charges and fees.

Deposit Processing Time at Exness

Most deposit methods on Exness are processed immediately, ensuring swift funding of your trading account:

- Bank wire transfers typically require 3-5 business days for processing.

- Deposits made using credit or debit cards are often processed right away.

- Online payment systems such as Skrill and Neteller are known for their quick processing times.

- Deposits in cryptocurrency usually need some confirmations on the blockchain but are generally completed within an hour.

- It’s advisable to regularly review any updates or modifications to deposit processing times on the Exness platform for the most current information.

Ensuring the Security of Your Deposits with Exness

Exness takes rigorous steps to ensure the safety of your funds:

- Utilizes cutting-edge security protocols to shield your deposits.

- Maintain your funds in accounts that are distinct from the company’s operational finances.

- Employs encryption technology to protect your financial transactions.

- Enhances account security with two-factor authentication.

- Conducts periodic audits and oversight to adhere to regulatory norms.

- Offers insurance on client funds for an added layer of safeguarding.

- Advises staying alert to phishing and unauthorized account access.

- Urges immediate contact with Exness support upon detection of any suspicious actions.

FAQs: Minimum Deposit at Exness

What are the deposit rates at Exness?

Exness offers competitive deposit rates based on the chosen payment method, including bank wire transfer, credit/debit cards, and online payment systems like Skrill and Neteller. Each method has its own processing times and fees.

What deposit methods are available at Exness?

Exness provides various deposit options, including bank wire transfers, credit/debit cards, and online payment platforms like Skrill and Neteller. Availability may vary depending on location and regulatory requirements.

Are there any deposit charges or fees at Exness?

Exness does not charge any deposit fees across all account types. Deposits into Exness accounts are free of charge, and Exness absorbs any deposit fees charged by payment systems. However, some payment methods may have their own fees, which will be clearly displayed during the deposit process.

How long does it take for deposits to be processed at Exness?

Most deposit methods at Exness are processed immediately, ensuring swift funding of your trading account. Bank wire transfers typically require 3-5 business days for processing, while deposits made using credit or debit cards are often processed right away. Online payment systems such as Skrill and Neteller also have quick processing times.

What currencies can I use for my Exness account?

Exness offers a diverse selection of currency options for trading accounts, including major currencies like USD, EUR, GBP, and JPY, as well as AUD, CAD, and CHF. The availability of currency options may vary based on geographical location and account type.

How do I deposit funds into my Exness account?

To deposit funds into your Exness account, sign in, navigate to the “Deposit Funds” area, choose your desired deposit method, specify the amount, and follow the given instructions for the chosen payment method. Confirm the transaction to finalize the deposit.

How does Exness ensure the security of deposited funds?

Exness employs stringent security measures to safeguard deposited funds, including advanced security protocols, encryption technology, two-factor authentication, regulatory compliance, insurance on client funds, and prompt action against suspicious activities.